| A | B |

|---|

| FDIC | Federal Depository Insurance Corporation |

| FDIC | Corporation that insures bank deposits up to $100,000 |

| Federal Reserve | Governmental agency in charge of banking and money control |

| The Fed | Short name for the Federal Reserve |

| Alan Greenspan | Current chair of the Federal Reserve Board of Governors |

| Ben Bernanke | Appointed to be the new chair of the Federal Reserve Board of Governors |

| Discount Rate | Short term interest rate set by the Fed for bank loans |

| Reserve Requirements | A percentage of demand deposits that banks must keep on deposit at the Fed |

| Open market operations | the buying and selling of U.S. Treasury Bonds (securities) to control money supply |

| Loose (expansionary) monetary policy | the type of monetary policy that would increase the money supply |

| Loose (expansionary) monetary policy | the type of monetary policy normally pursued during a recessionary period |

| Loose (expansionary) monetary policy | the type of monetary policy normally pursued during a depressionary period |

| Loose (expansionary) monetary policy | the type of monetary policy that might increase inflation |

| Loose (expansionary) monetary policy | the type of monetary policy that should be pursued if GDP is decreasing |

| Loose (expansionary) monetary policy | the type of monetary policy that should be implemented when unemployment is high |

| Tight (contractionary) monetary policy | the type of monetary policy that would decrease the money supply |

| Tight (contractionary) monetary policy | the type of monetary policy that would be pursued if inflation were high |

| Tight (contractionary) monetary policy | the type of monetary policy that might cause a slowing of economic growth |

| Tight (contractionary) monetary policy | the type of monetary policy that might cause an increase in unemployment |

| CPI | stands for consumer price index - measures inflation |

| GDP | total value of all goods and services produced in the economy |

| Economic growth | an increase in real GDP |

| Inflation | an increase in the CPI |

| Above about 3% | inflation rate at which the Fed may implement a tight monetary policy |

| Full employment | an unemployment rate of 4% or lower is considered ________. |

| Above 5% | Unemployment rate at which the Fed may begin to loosen the money supply |

| Declining GDP | point at which the economy is contracting |

| Recession | declining GDP for 2 consecutive quarters |

| Depression | Severe, prolonged recession - high unemployment, declining GDP |

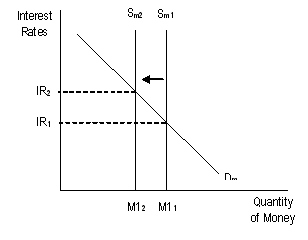

| How interest rates are determined | where demand for money intersects with the money supply |

| It is a fixed amount | why the money supply "curve" is a vertical line |

| Economic indicators | things the Fed looks at to determine the type of monetary policy to pursue |

| Functions of money | store of value, medium of exchange, measure of value |

| Monetary policy | the alteration of the money supply to try to ensure economic and price stability |

| Indicators that the Fed should contract the money supply | High inflation |

| Indicators that the Fed should expand the money supply | High unemployment, low or declining GDP |

| People's belief in it, the health of the economy | the things that "back up" money |

| Board of Governors | the governing body of the Federal Reserve |

| 12 | How many Federal Reserve districts there are |

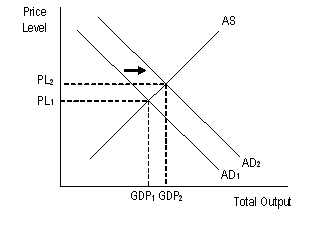

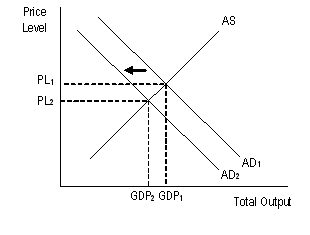

| Aggregate Demand and Supply | Total demand and supply for all goods in our economy |

| Lower Reserve Requirements & Discount rate, Buy bonds | The three tools of the Fed and how they would be used to implement a loose monetary policy |

| Raise Reserve Requirements & Discount rate, sell bonds | The three tools of the Fed and how they would be used to implement a tight monetary policy |

| Aggregate demand increases | What happens when overall interest rates decline? |

| Aggregate demand decreases | What happens when overall interest rates increase? |

| Financial services of the Fed | check clearing, working as the nation's bank, maintaining the integrity of the money supply, consumer services |

| Banking supervision role of the Fed | Making rules and regulations that banks must follow, doing audits to protect consumers |

| Expansionary monetary policy |  |

| Contractionary monetary policy |  |

| Expansionary monetary policy would cause this effect |  |

| Contractionary monetary policy would cause this effect |  |